Many people think they are property experts, but few are, including the media.

Experience tells us that smart property investment decisions are best made by tuning out the news media, which can be relentlessly negative, fuelled by pessimistic forecasts from economists whose track records in predicting real estate outcomes are questionable at best.

Those who listened to such forecasts before the pandemic and believed it was a bad time to invest missed out on reaping the benefits of an Australia-wide property boom.

When the news is relentlessly negative, potential property investors are asking:

- Is it still a good time to invest?

- Should I just wait?

- Are new builds a good investment?

- Where are the best places to invest?

- Who should you listen to?

Investment expert Danny Buxton of Triple Zero Property, and Hotspotting founder Terry Ryder answered these important questions from investors on a recent webinar.

IS IT STILL A GOOD TIME TO INVEST?

Danny Buxton says one of the fundamentals of making smart property investment decisions is to tune out the media.

He says at the beginning of COVID and in 2023, as interest rates kept rising, the media was full of doom and gloom messages about its drastic effect on the market.

“And you know what, it didn’t happen,” Danny says, “You’ve got to look at the fundamentals.”

“I think it’s a great time to be buying because the demand is so strong and I can’t see it easing anytime soon”.

SHOULD I WAIT?

Firstly, let’s look at what happened in 2020, where many people took their investment advice from what they heard on the news and didn’t invest.

Danny said,” Procrastination can cost investors from the missed opportunities waiting for just the right time.”

“Now that the market has changed again, many potential investors are sitting on the fence. The only way you make money is by actively exploring specific projects and their returns and if the numbers stack up – go for it!”.

ARE NEW BUILDS A GOOD INVESTMENT?

With Australia’s population expected to continue to soar, aided by growing international migration, there is massive demand for more housing.

In southeast Queensland, 12.2 million people are tipped to move there by 2046.

“So in the next 23 years we need 900,000 new homes, that’s 40,000 homes per annum that we need to create in southeast Queensland,” Danny says.

“At the moment, in Queensland, we’re doing 30,000. So we’re already 10,000 short this year, which means next year it’s 40,000 plus another 10,000, and we’re not going to 50,000 next year.

“We are not creating and building enough properties.”

While some builders are going broke, Danny says it is still a good investment strategy if you do the proper checks and balances beforehand.

“I see a massive opportunity for us to capitalise as investors by building an investment property, but you have the right people around you to reap those rewards. You must ensure the builder is financially strong and look at the quality of their builds and finishes.

New builds offer good tax advantages, with 100% of the construction of the house tax deductible, and they have very few maintenance costs and issues.

WHERE ARE THE BEST PLACES TO INVEST?

When it comes to picking the actual suburb, Danny says you need to look at the future population growth to ensure there will be demand from renters and land supply. Good local economic growth and infrastructure spending are also essential.

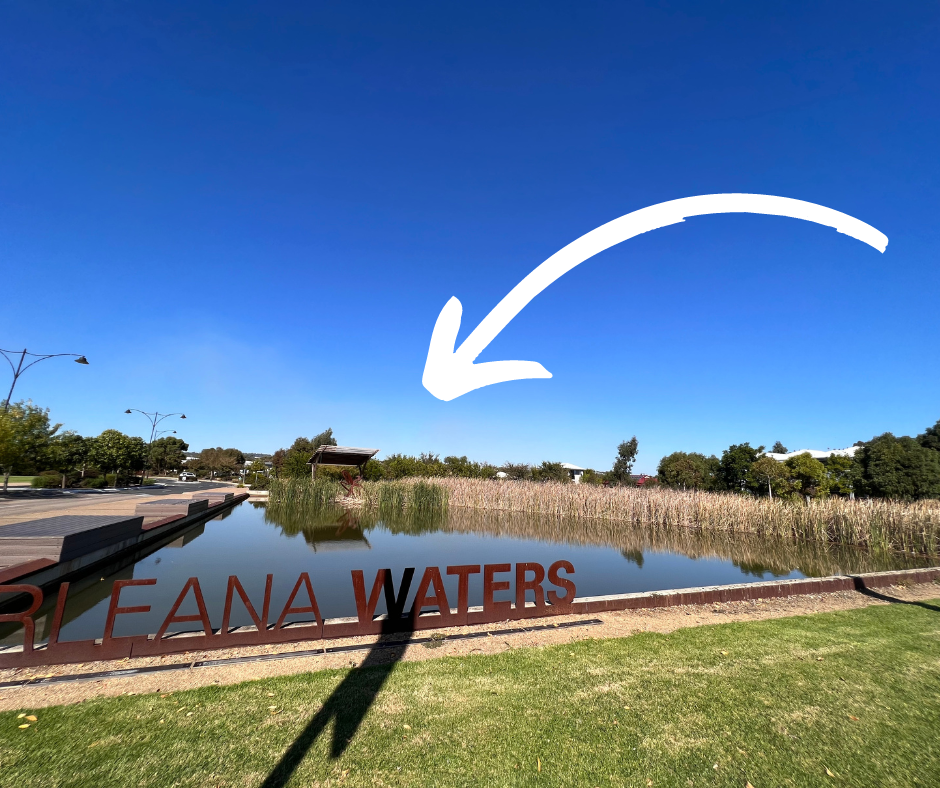

Danny believes there are great investment opportunities in South Australia and Queensland.

“Sunshine Coast, Brisbane, Adelaide are big standout areas,” he says, “because of the multiple growth drives in these areas.”

“Of course, there are other specific markets with a growth trajectory, but I know in these areas I can hand-pick the very best options for the clients I represent”.

WHO SHOULD YOU LISTEN TO?

“It staggers me that people go out and buy an investment property without building and consulting a team of specialists. Having an independent (not in-house) financier, accountant, and conveyancer is vital to cross-check your decisions.

Getting your advice from these experts rather than from chatting around the barbecue or through your colleagues at work is Danny’s advice here.

WHAT IS YOUR NEXT MOVE TO GROW YOUR PROPERTY PORTFOLIO?

As Australian property prices continue to defy expectations – are you ready to make the most of it?

Talk with one of the team at Triple Zero Property about your property goals by calling 1300 897 000 or emailing [email protected].

This content is general information only. Your situation is specific and individual; as such, you should always consult a registered and qualified professional within the particular area of advice needed.